Employment classification is vital in determining various rights, obligations, and employee benefits including an employee’s right to L&I benefits. Ensuring an individual is appropriately classified as either an independent contractor or employee is highly important for both workers and employers.

The Difference Between Independent Contractors and Employees

Determining employment status either as an independent contractor or as an employee (worker) is complicated, considering how different government agencies such as Labor and Industries and the Internal Revenue Service define the roles.

Independent Contractor

Independent contractors are independent workers with autonomy and flexibility hired to perform a specific limited task. They usually have their own tools and their own company. They are not controlled by an employer. When they are done with their tasks, they get paid for the work completed but do not receive benefits such as health insurance and paid time off. They pay their own income taxes after receiving a 1099. They are responsible to pay their own state and local taxes, Social Security, Medicare , and vacation.

Example: When a homeowner hires a plumber, that plumber is an independent contractor to the homeowner because they perform a specific limited task and get paid upon completion of the job.

Employee

An employee is on a company’s payroll and receives wages and benefits by working on an ongoing basis. They are paid for their time in exchange for following the employer’s guidelines and remaining loyal to the company. They are controlled by their employer. Washington State statute RCW 51.08 specifies who is a worker and those individuals who are exceptions to the definition. The employer is responsible for withholding and paying income taxes, Medicare tax, Social Security tax, unemployment insurance, and workers compensation. The employer may be responsible for overtime, family leave, sick pay, health insurance and vacation.

Example:

That same individual plumber working as an independent contractor for the homeowner is considered an employee of the plumbing company because they work for the company, follow the company guidelines, and get paid for their time.

Why Employment Status Matters

An individual’s status as an independent contractor or an employee makes a huge difference in various legal and business aspects including tax status, having to pay social security, record keeping, benefits, insurance, third-party lawsuits, L&I claims, premiums, and assessments.

If you are an employer or working trying to figure out proper classification for business and their purposes, this website is not for you. You should direct your search elsewhere, to the IRS or tax attorney.

If you have been injured and you are looking for information about an employee vs independent contractor status and workers compensation benefits, this web page is for you.

Washington State L&I Workers’ Compensation for Injured Independent Contractors vs. Employees

In Washington State employees (workers) can file an L&I injury claim. An independent contractor cannot (unless they paid premiums for coverage.)However, simply being labeled an independent contractor by an employer does not make it true. Many employers misclassify individuals as independent contractors who they should classify as employees and pay for L&I coverage.

If you are an independent contractor, you can buy your own L&I insurance to protect against workplace injuries. However, if you are uninsured, this does not mean that you cannot receive compensation for a workplace injury. Independent contractors have the right to sue for negligence that leads to their injury. Injured independent contractors may file personal injury claims against negligent parties. They can also file a premise liability claim against the owner of the property where the injury occurred or a product liability claim against the manufacturer of a product that caused an injury. Also, independent contractors may file for long-term disability or Social Security Disability benefits after experiencing a workplace injury.

If you are told you are an independent contractor, and you have suffered a workplace injury, speak with a reputable workers’ compensation attorney to ensure you aren’t being misclassified and learn about other avenues available based on the circumstances surrounding your injury.

Determining an Individual’s Employment Status

The essence of the employment relationship is the worker’s personal labor. In general, an employer controls an employee. However, there is much more to determining a worker’s status. The most critical factor in determining an individual’s employee or independent contractor status is one of direction and control.

L&I uses specific tests to determine coverage and they expect employers to document how each contractor passes each part of the tests.

The Personal Labor Test

To determine if an individual provides more than personal labor and is an independent contractor, L&I uses the Personal Labor Test. If one of these two statements is true, then the individual is an independent contractor:

- The individual brings their own employees to perform the work, and you don’t control the individual or their employees.

- The individual brings heavy or costly specialized heavy equipment and their expertise to operate it, and you don’t control the individual (Examples: MRI machine, earth-moving equipment, ultrasound machine).

The 6-Part and 7-Part Test

Suppose the worker does not qualify as an independent contractor according to the personal labor test. In that case, the employer must then use the 6-part or 7-part test, as per RCW 51.08.195, to determine if the employee is a worker or an independent contractor. When using the 6-part or 7-part test, a worker must pass all six parts to be exempt from coverage (or seven parts for construction jobs).

If an individual doesn’t pass all parts of these tests, they are not an independent contractor, and the employer must provide workers’ compensation. To be considered an independent contractor, the individual must:

- Be free from the employer’s control or direction.

- Pass 1 of the following 3 options:

- The service is outside the usual course of business.

- The service is performed outside all of the places of business.

- The individual is responsible for the costs of the principal place of business from which the service is performed.

- Pass 1 of the following 2 options: The individual:

- Is customarily engaged in an independently established trade, occupation, profession, or business, of the same nature as that involved in the contract of service.

- Has a principal place of business that is eligible for a business deduction for IRS purposes.

- The individual is responsible for filing a schedule of expenses with the IRS.

- The individual has established an account with the Department of Revenue and other state agencies as required.

- The individual is maintaining a separate set of books or records that reflect all items of income and expenses.

- For construction only: The individual is properly registered as a contractor or has a valid electrical contractor license.

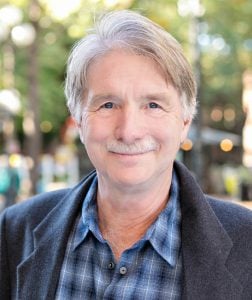

We Can Help Your Determine Your Right to Workers’ Compensation

At Sharpe Law Firm, we’ve been helping injured workers receive the compensation they deserve for more than forty years. Whether you’re an independent contractor or an employee, if you have suffered a workplace injury, we can help establish your right to L&I and other forms of recourse available after a workplace injury.

Contact us today to schedule a complimentary consultation to discuss your case and determine the best course of action given your circumstances.

Frequently Asked Questions About Independent Contractor Status in Washington State

Yes, they do, L&I coverage is mandatory, and nearly all workers must be covered.

Yes, there are exceptions to mandatory L&I coverage, including domestic servants, gardeners & handypersons in or about the employer’s private home, sole proprietors or partners, bona fide corporate officers, entertainers, newspaper vendors, certain vehicle operators, and others.

Not necessarily. A worker’s classification depends on the formal tests used by L&I and the Courts to determine whether a worker is an independent contractor or a worker. What the employer calls the worker does not make it so.

Not necessarily. You could sign a contract saying you are the man on the moon, and it would not be accurate. The agreement signed between you and your employer does not control how Labor and Industries determines employment and independent contractor status.

Tax form 1099 sent to you by an employer does not make you an independent contractor. A 1099 is a federal tax form used for federal tax purposes. It does not determine how L&I will apply its rules. It is some evidence of your employment relationship but it is not conclusive.

There are several advantages for employers when they hire independent contractors, including

– No obligation to pay L&I premiums

– No negotiations with unions

– No obligation to pay benefits like health care, retirement plans, sick leave, and overtime pay

– It can cost less

– Independent contractors generally bring expertise and tools to the job

The main disadvantage for employers who hire independent contractors is that the independent contractor can sue the employer for negligence, whereas an employee cannot.

– OK news for the injured worker. You should be covered by L&I. Contact us and we’ll help you get in touch with L&I and get you L&I coverage.

– Bad news for the employer. There will be an audit. If there has been a misclassification there will be an order of assessment and penalties, premiums, interest, wage issues such as overtime and benefits. It does not pay to misclassify a worker.

– No problem for the employee.

– Bad news for the employer. L&I does not like this and will investigate. Here is a good article on employer audits from L&I L&I Field Audits

– More bad news for employers. Employers who unfairly compete by not paying L&I premiums are considered to be cheaters. L&I and other state and federal agencies aggressively audit and police employers. They are watching the line between employee and Independent Contractor. If they find an employer on the wrong side of the line, it could get expensive.

Many agencies, including the Federal Department of Labor, Internal Revenue Service, Employment Securities, and Washington State Department of Labor and Industries, define independent contractors in their own way, and each agency has its own tests. This page is written for injured workers in the Washington Labor and Industries system. If you are an employer or interested in another system, contact them or a lawyer who does that work.

L&I will absolutely help properly classify their workers so long as the employer approaches L&I first. They also provide a helpful Guide to Hiring Independent Contractors in Washington State that we recommend reviewing.